A financial budget is like a roadmap for your money. It helps you track your income, manage your expenses, and plan for future goals.

But the key to success lies in making that financial budget realistic, something you can actually stick to. Let’s walk through the steps of creating a budget, using a simple example to bring it to life.

1. Know Your Monthly Income

The first step in budgeting is knowing exactly how much money you bring in each month. This includes your primary salary, freelance earnings, rental income, or any other regular sources of money. Knowing your total income helps you plan your spending without overestimating what you can afford.

Example:

Let’s say Riya earns ₹50,000 per month from her full-time job and makes an additional ₹5,000 from freelance writing.

Total monthly income = ₹55,000

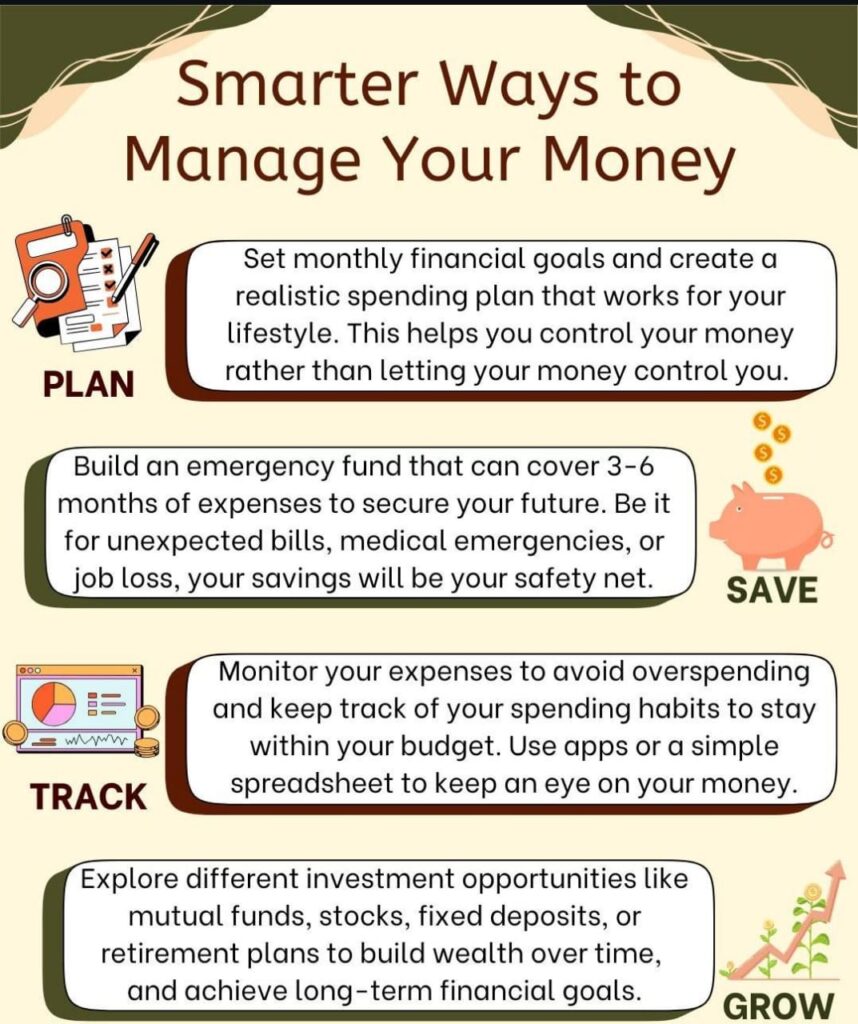

2. Track Your Expenses for an Effective Financial Budget

Before you can create a budget, you need to understand where your money is going. Track your expenses for at least a month. Categorize them into:

- Fixed expenses – rent or mortgage, utilities, insurance premiums

- Variable expenses – groceries, fuel, entertainment, dining out

- Periodic expenses – annual fees, car maintenance, holiday shopping

You can use budgeting apps, spreadsheets, or even a notebook to record and analyze your spending habits.

Example:

| Category | Expense (₹) |

| Rent | 15,000 |

| Groceries | 6,000 |

| Transportation | 3,000 |

| Utilities (electricity, water, etc.) | 2,000 |

| Dining out | 3,000 |

| Subscriptions (Netflix, etc.) | 1,000 |

| Savings | 7,000 |

| Emergency Fund | 2,000 |

| Miscellaneous | 1,500 |

| Total | 40,500 |

Now Riya knows where her money is going and what she can adjust to plan her financial budget accordingly.

3. Set Clear Financial Goals

What do you want to achieve with your budget? Clear goals help guide your financial decisions. These may include:

- Paying off credit card debt

- Building an emergency fund (typically 3-6 months of expenses)

- Saving for retirement or education

- Planning a vacation or major purchase

Set SMART goals — Specific, Measurable, Achievable, Relevant, and Time-bound — to stay motivated and on track.

Example:

- Save ₹1,00,000 in one year for a solo trip

- Build an emergency fund worth ₹50,000

- Pay off ₹20,000 credit card debt in 6 months

These goals will guide her budgeting decisions.

4. Build the Budget Using 50/30/20 Rule

Now that you know your income and expenses, it’s time to create your financial budget. Use the 50/30/20 rule as a basic guideline:

- 50% for needs (housing, groceries, transportation)

- 30% for wants (entertainment, hobbies, dining out)

- 20% for savings and debt repayment

Adjust these percentages to suit your lifestyle and goals. The key is ensuring your total expenses don’t exceed your income.

Example (Based on Riya’s ₹55,000 Income):

- Needs (50%) = ₹27,500

(Rent, groceries, utilities, transport) - Wants (30%) = ₹16,500

(Dining out, entertainment, subscriptions) - Savings & Debt (20%) = ₹11,000

(Emergency fund, savings, credit card payment)

By comparing these to her actual expenses, Riya sees that her “wants” are slightly high, so she decides to cut back on dining out by ₹1,000.

5. Build in Flexibility

Unexpected expenses are inevitable, so it’s important to leave room in your financial budget for them. Consider allocating a small amount each month for miscellaneous or unplanned costs. Being flexible helps prevent the stress of budget derailment.

Example:

Riya allocates ₹1,500 every month under “Miscellaneous” for unexpected costs like medical bills, gifts, or a sudden repair need.

6. Review and Adjust Monthly

A financial budget isn’t a “set it and forget it” tool. Review it regularly.

Example:

In August, Riya gets a freelance bonus of ₹10,000. She decides to put ₹7,000 into her emergency fund and use ₹3,000 for her upcoming trip.

A realistic budget keeps you in control of your money, not the other way around.

Like Riya, if you know your income, track your expenses, set clear goals, and adjust regularly, you’ll be well on your way to financial stability and peace of mind. Start today, and your future self will thank you.