Ever since the US Presidential Elections 2024 was announced, the global market has witnessed many ups and downs. The fear of reciprocator and high tariffs, FII sell-off, and various other factors contribute to a volatile market. So, if you are an investor or just want to park your extra money to get delightful returns, which type of investment option is best?

The regular savings bank account earns an interest of 3.5-6%, too, with so many terms and conditions and unnecessary charges. Moreover, the highly volatile share market can make it risky for beginners to invest in a fluctuating market that has been seeing downwards trends since last October.

And this has made deciding on the right investment choices even more difficult.

Here, we will compare the two more popular investment options among Indian consumers – SIP (Systematic Investment Plan) and RD (Recurring Deposit).

Both these offer unique benefits and have their own drawbacks that further make investment choice a daunting task.

What is SIP?

The System Investment Plan (SIP) is an investment strategy where you invest a fixed amount of money at regular intervals, usually every month, in a mutual fund scheme.

This type of investment helps investors to average out the cost of their investment over a longer period of time and reduces the impact of market fluctuations. In this type of investment, when the market is down, you can buy more units, and when it is going up, you buy fewer units.

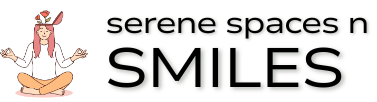

This strategy, also known as rupee-cost averaging, helps investors to achieve higher returns in the long run. The chart below shows the top-performing Mutual Fund Schemes and their returns in the last 5 years.

What advantages do SIP offer?

Here are some of the notable benefits of investing in SIP schemes:

- Rupee-cost averaging: SIPs help cope up with market volatility by averaging out the purchase cost of units.

- Chances of getting higher returns: Historically, SIPs in equity mutual funds have delivered higher returns compared to traditional fixed-income instruments like RDs

- Flexibility: You can start, stop, and even modify your SIP amounts as per your financial situation.

- Disciplined investing: SIPs encourage investors to save in a disciplined manner and help them remain committed to investing with a fixed amount regularly.

Disadvantages of SIPs

SIPs can undoubtedly help users earn higher returns, but there are some drawbacks that they must be careful about including:

- Market risk: SIPs are subject to market risks, and the value of your investment can fluctuate.

- No guaranteed returns: If the market goes up, you earn a profit, if the market goes down, you incur a loss. Unlike RDs, SIPs do not guarantee fixed returns.

- Requires research: Choosing the right mutual fund scheme for your SIP requires proper research and an understanding of the market.

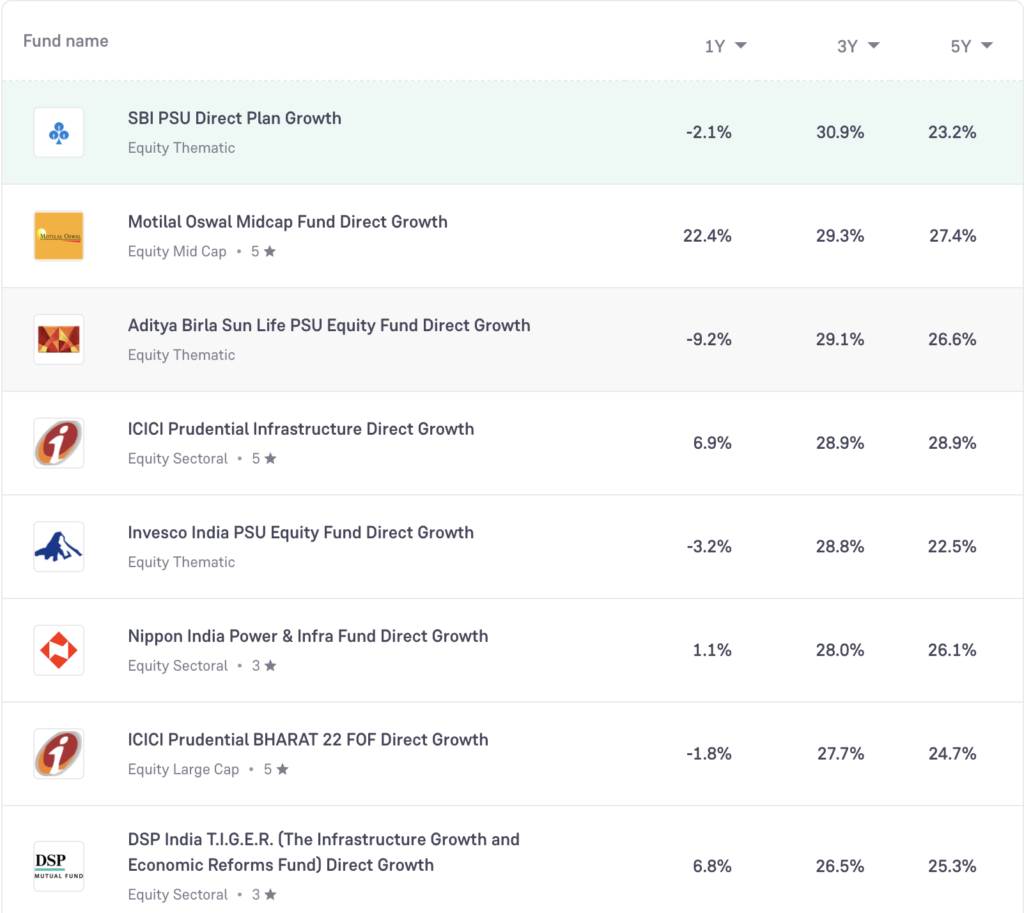

It should be noted that mutual funds are basically invested in the stock market, and therefore, it is wise to consider the market environment before investing. The following chart shows consistent downward movement in stock prices. This is discouraging for many investors, and this can be considered a good time to put money in the market and buy higher units. It all depends on the investor’s perception.

What are Recurring Deposits?

A Recurring Deposit (RD) is a traditional savings scheme offered by banks and post offices. In this type of investment, you deposit a fixed amount of money every month for a predetermined period, usually 6 months to 10 years.

In the RD scheme, you earn a fixed interest rate, and you can withdraw the principal and accrued interest amount together at the end of the tenure.

Advantages of RDs:

Apart from offering fixed interest returns, you can enjoy benefits like:

- Low Risk: RDs are often considered low-risk investments because your principal amount is protected, and you receive guaranteed returns as described at the beginning of the investment.

- Disciplined Savings: RDs encourage disciplined savings habits as you commit to depositing a fixed amount regularly.

- Guaranteed returns: RDs offer fixed returns, providing a sense of security and predictability. Major RD schemes in India offer 6 to 7 percent return on RD investments.

- Rebate on investment: Some RD schemes, such as the ones offered by Post Offices, offer up to 40% rebate on the monthly amount if a deposit is made 1 year in advance.

Here is a comparison of RD interest rates in major Indian banks and the standard tenure of the schemes

| Bank Name | RD Interest Rates | Tenure |

| SBI | 6.5% to 7% | 12 months to 120 months |

| ICICI | 4.75% to 7.25% | 6 months to 120 months |

| HDFC | 4.5% to 7.25% | 6 months to 120 months |

| Kotak | 6% to 7.4% | 6 months to 120 months |

| Post Office | 6.7% | 60 months |

| Bank of India | 4.5% to 7.25% | 3 months to 120 months |

| Punjab National Bank | 6.5% to 7.25% | 6 months to 120 months |

Source: Cleartax, Paisabazar, and official bank websites.

These interest rates can be changed without prior notification. It is therefore recommended to check with the bank on latest RD interest rates for the given duration.

Disadvantages of RDs:

Before blindly investing in recurring deposits, you must be aware of its drawbacks to make an informed decision. this includes:

- Lower returns: While SIPs can offer returns upto 20% and even more in long run, RDs typically offer lower returns.

- Fixed tenure: RDs also come with a fixed tenure, and closing the savings prematurely may attract penalties

- Less flexibility: RDs offer less to no flexibility in terms of investment. You cannot modify the amount; you cannot skip any monthly installment and not stop in between. Doing any of these will incur penalties.

So, SIP vs. RD: Which is better in a turbulent market?

In a turbulent market, both SIPs and RDs have their own advantages. If you are a risk-averse investor looking for guaranteed return and want to protect your capital, then RDs are the suitable option. However, if you can take the risk and can patiently wait for a longer period of time usually more than 5 years to get higher returns, then SIPs can offer you diversified equity mutual funds and will be a better choice for you.

Disclaimer: Mutual fund investments are subject to market risks. Please read the offer document carefully before investing.

By carefully considering your financial goals, risk appetite, and current market conditions, you can make an informed decision about whether SIPs or RDs are the better investment option for you.